A 5 Minute Overview Of

Die with Zero

Getting All You Can from Your Money and Your Life

About the Author

Bill Perkins is a hedge fund manager and entrepreneur. After studying electrical engineering at the University of Iowa, he took a job as a screen clerk for the New York Mercantile Exchange earning $16,000 a year in the 90's. He later moved to Houston, Texas where he directed NorthernStar Natural Gas, was CEO of Cutuco Energy Central America, and personally generated more than $1 billion for his hedge fund as an energy trader. He is currently the CEO of BrisaMax Holdings, a consulting services firm. Bill Perkins has also produced several films and is an avid poker player with more than $5 million in live tournament winnings.

The Main Idea

What's your optimum retirement strategy? Are you going to just keep working long hours in order to sock away more and more money that you'll never get around to spending because you're working?

The Die With Zero philosophy is once you've saved enough to fund your retirement and give to your family and charities, you should start focusing more on generating memorable life experiences. That's the time to live life to its fullest, not to be pulling even longer hours in the office, or waiting until you're too old to be able to enjoy doing things.

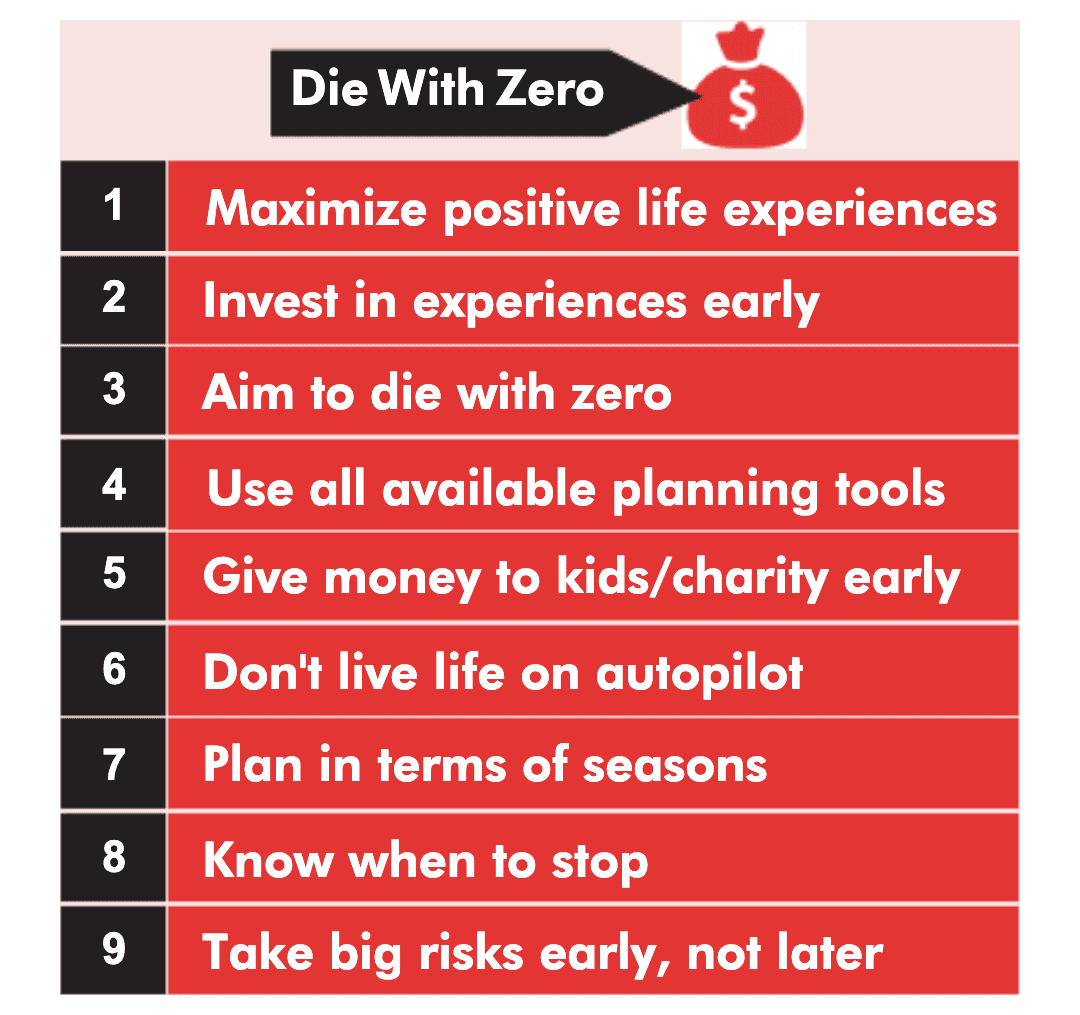

There are nine rules to apply to live the Die With Zero philosophy:

If you spend hours and hours of your life acquiring money and then die without spending all of that money, then you've needlessly wasted too many precious hours of your life. There is just no way to get those hours back. If you die with $1 million left, that's $1 million of experiences you didn't have. And if you die with $50,000 left, well, that's $50,000 of experiences you didn't have. No way is that optimal. The question we all must answer is how to make the most of our finite time on earth.

How to Plan and Fund Your Retirement

1. Rule #1 — Maximize positive life experiences. Don't wait until you retire to start doing stuff you like. Start actively having the life experiences you want to have now. Have lots of meaningful and memorable experiences.

2. Rule #2 — Invest in experiences early. Your life is the sum of your experiences, and when you look back you'll remember the richness of those experiences. Plan the experiences you want to fit in and start now.

3. Rule #3 — Aim to die with zero. Ideally, you should aim to die with zero — having spent your money on having great personal experiences, taking care of your family, and leaving a legacy. That's the aim.

4. Rule #4 — Use all available planning tools. You don't know exactly when you will die, but there are tools available which will give you a rough idea of what your life expectancy is. Use those tools as part of your planning.

5. Rule #5 — Give money to kids/charity early. Give your children whatever you have allocated for them before you die. There's no point in waiting until you're gone. That way you can give when it has the most impact on their lives as well.

6. Rule #6 — Don't live life on autopilot. There are no universal laws when it comes to personal finance and balancing competing demands. Don't live on autopilot, be prepared to make constant, personalized changes.

7. Rule #7 — Plan in terms of seasons. We all die eventually, and you'll pass through several stages or seasons before then. Make sure you plan your experiences accordingly, rather than blithely assuming you'll go forever.

8. Rule #8 — Know when to stop. There is an optimal point at which you should stop working for maximum lifetime fulfillment. Figure out what that is before you blow right past it. Nobody on their death beds wishes they had spent more time at the office.

9. Rule #9 — Take big risks early, not later. The younger you are, the more risks you should be taking, and the bolder you should be. Identify opportunities that pose little risk and go for it. You won't be able to do this once you get older.

Key Takeaways

- Funding your retirement is important, but if you die without spending all that money, you've wasted precious hours of your life. Arrange your finances so you die with zero. Know when to stop working and start living.

- There's really no prizes for being the richest person in the cemetery. Live your life to the fullest now, don't wait until you retire. Give money to your kids and to causes you care about now, not at some random date in the future. That's the way to live life.

You should be focusing on maximizing your life enjoyment rather than on maximizing your wealth. Those are two very different goals. Money is just a means to an end: Having money helps you to achieve the more important goal of enjoying your life. But trying to maximize money actually gets in the way of achieving the more important goal.

Summaries.Com Editor's Comments

I can't speak for you, but my personal approach to retirement planning is to say I plan on working forever, and they're going to have to pry my keyboard out of my cold hands once I go the way of all the world. Somehow, I plan on beating the odds and outliving all my peers by a large margin. Of course, that's just wishful thinking, but this week's book, Die With Zero, talks about a much more realistic and practical way to approach retirement planning.

Bill Perkins, the author of Die With Zero, trained as an engineer before making a fortune as an energy stock trader for a hedge fund. He points out that lots of people get obsessed with funding their retirement, and overshoot the mark. They just keep working and socking away money until they get to the point they are too old and frail to go out and have some memorable life experiences. They keep working to make money that they never have the time or energy to spend.

This waste drove Bill Perkins crazy, so he came up with his "Die With Zero" philosophy.

Approaching it like an engineer, he calculates what the real sweet spot is (Your Peak Worth) where it makes sense to stop worrying obsessively about making money, and instead start spending more money on high quality experiences that will pay massive memory dividends for you (and your family) well into the future. He also suggests that you give money to kids and charities earlier when it will make a difference rather than later at the random time you finally pass away.

Whatever your personal philosophy, this financial planning book is thought provoking and interesting. I highly recommend it.

Want in-depth 30-minute summaries?

In addition to this 5-minute overview, Summaries.Com has a premium 30-minute summary of this book and 1,000+ more, to help you advance your career and business.

Check Out Summaries.com Premium Plans Today!Want more 5-minute Snapshots?

To get a new 5-minute business book snapshot each week, sign up for the Summaries.com free plan.

Sign Up for the Summaries.com Free PlanRetirement Planning 101 Collection

If you enjoyed this summary, here is a collection of related business book summaries, to help you get ideas and strategies that will give you an edge over your competition.

This mini-course will give you ideas on how to plan for and fund your retirement.

Buy Retirement Planning 101 Collection (5 x 30-Min Summaries)

Die with Zero

Getting All You Can from Your Money and Your Life

by Bill Perkins

Start Late, Finish Rich

A No-Fail Plan For Achieving Financial Freedom At Any Age

by David Bach

Debt Free for Life

The Finish Rich Plan For Financial Freedom

by David Bach

Unshakeable

Your Financial Freedom Playbook

by Tony Robbins

Money Master the Game

7 Simple Steps to Financial Freedom

by Tony Robbins