A 5 Minute Overview Of

Narrative and Numbers

The Value of Stories in Business

About the Author

Aswath Daomdaran is a professor of finance at New York University's School of Business. He teaches courses on corporate finance and equity valuation. He has published extensively in academic journals and has also written several books about equity valuation and investments. Dr. Damodaran was previously a visiting lecturer at the University of California, Berkeley and he currently participates in the TRUIM Global Executive MBA Program which is run by NYU, the London School of Economics and HEC School of Management. He is a graduate of the University of California, Los Angeles, Madras University and the Indian Institute of Management Bangalore.

The Main Idea

How do you establish the true market value of an asset? This is rather obviously an important question for any investment decision.

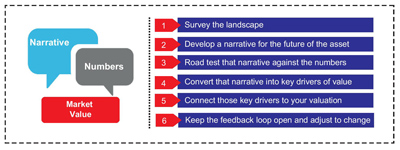

One school of thought (left brain) suggests value is driven solely by the numbers and therefore number crunchers can calculate market value with formulas and a spreadsheet. An alternate approach (right brain) is to look at the underlying story or narrative behind the asset and use storytelling to come up with a valuation. A much better approach to valuation is to blend together both the numbers and the underlying narrative. To come up with a good valuation, you have to be able to talk both languages. You have to take the numbers and then give them context on the basis of the background narrative.

A much better approach to valuation is to blend together both the numbers and the underlying narrative. To come up with a good valuation, you have to be able to talk both languages. You have to take the numbers and then give them context on the basis of the background narrative.

Stories without numbers are little more than fairy tails. Numbers without stories are exercises in financial modelling. A good valuation is a bridge which will draw on both the numbers and the stories to come up with a figure that makes sense.

In effect, valuation allows each side to draw on the other, forcing storytellers to see the parts of their stories that are improbable or implausible, and to fix them, and number crunchers to recognize when their numbers generate a story line that does not make sense or is not credible.

Want in-depth 30-minute summaries?

In addition to this 5-minute overview, Summaries.Com has a premium 30-minute summary of this book and 1,000+ more, to help you advance your career and business.

Check Out Summaries.com Premium Plans Today!Want more 5-minute Snapshots?

To get a new 5-minute business book snapshot each week, sign up for the Summaries.com free plan.

Sign Up for the Summaries.com Free PlanStory Mastery Collection

If you enjoyed this summary, here is a collection of related business book summaries, to help you get ideas and strategies that will give you an edge over your competition.

This mini-course will give you ideas about how business stories work to your advantage.

Buy Story Mastery Collection (5 x 30-Min Summaries)

Narrative and Numbers

The Value of Stories in Business

by Aswath Daomdaran

Choose Your Story Change Your Life

Silence Your Inner Critic and Rewrite Your Life from the Inside Out

by Kindra Hall

Stories That Stick

How Storytelling Can Captivate Customers, Influence Audiences, and Transform Your Business

by Kindra Hall

Building a Story Brand

Clarify Your Message So Customers Will Listen

by Donald Miller

Lead with a Story

A Guide to Crafting Business Narratives That Capitvate, Convince, and Inspire

by Paul Smith